How to Select the Right Offshore Trustee for Your Wealth Management Needs

How to Select the Right Offshore Trustee for Your Wealth Management Needs

Blog Article

Factors You May Need an Offshore Trustee for Your Financial Planning

In today's complicated economic landscape, the duty of an offshore trustee can be pivotal for individuals looking for to improve their economic preparation techniques. These experts offer specialized competence in asset tax, defense, and privacy optimization, which can be vital in guarding wide range against lawful obstacles. Moreover, they promote effective sequence preparation, making sure that possessions are moved flawlessly across generations. The nuances of global laws and the potential advantages they provide warrant a more detailed examination to totally appreciate their influence on your financial approach. What could these insights imply for your future?

Property Protection Approaches

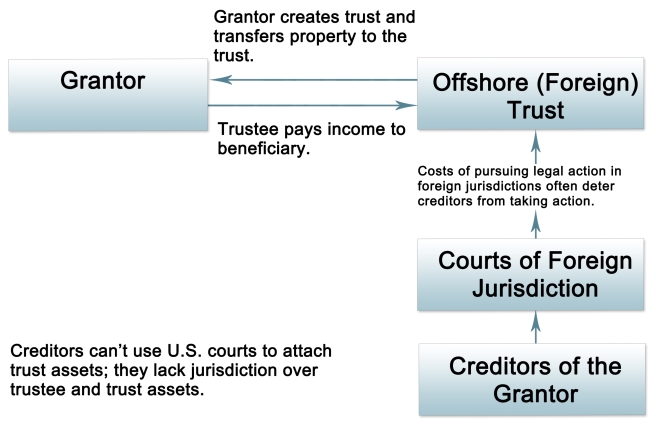

Asset protection strategies are vital devices for guarding riches versus prospective lawful claims and monetary obligations. These methods are specifically critical for companies and people encountering raised direct exposure to suits, lenders, or unanticipated financial obstacles. By employing effective property protection actions, one can preserve assets from being taken or accessed in the event of a lawful dispute.

Common methods consist of the facility of limited obligation entities, such as Restricted Obligation Firms (LLCs) or firms, which can secure individual properties from business-related responsibilities - offshore trustee. Furthermore, the use of irrevocable trusts can give a robust layer of protection, as properties transferred right into these counts on are generally exempt to lender cases

Furthermore, expanding financial investments throughout territories can reduce dangers associated with any type of solitary lawful system. Offshore trust funds, particularly, offer critical advantages by placing assets past the reach of domestic lawful claims while complying with international laws.

Inevitably, a well-structured possession security strategy is essential to economic preparation, allowing organizations and individuals to protect their riches while keeping conformity with applicable policies. Engaging with lawful and monetary professionals is advisable to customize strategies that best fit specific circumstances.

Improved Privacy and Confidentiality

Offshore territories usually have strict personal privacy regulations that protect customers' identities and monetary activities from public scrutiny. This implies that sensitive financial details can be managed inconspicuously, lowering the danger of direct exposure that may arise in more clear jurisdictions. By making use of an offshore trustee, customers can distance their possessions from public documents, making sure that their economic events stay private.

Additionally, offshore structures can promote anonymity in possession, permitting individuals to conduct transactions without exposing personal information. This can be specifically helpful for high-net-worth people or those in sectors where personal privacy is paramount.

Additionally, overseas trustees are typically accustomed to taking care of international customers, giving experience in browsing intricate personal privacy regulations. offshore trustee. On the whole, boosted personal privacy and discretion not just shield individual interests but additionally enable even more critical financial planning in a progressively transparent globe

Tax Obligation Optimization Opportunities

Using an overseas trustee not just improves privacy and privacy yet additionally opens up significant tax optimization opportunities. By developing an offshore depend on, individuals can frequently take advantage of desirable tax obligation jurisdictions, which may offer lower tax prices or also tax obligation exceptions on specific income types. This can be particularly helpful for high-net-worth individuals and entrepreneur seeking to reduce their worldwide tax obligations.

Offshore trust funds can assist in the calculated appropriation of possessions, enabling tax-efficient distributions to recipients. Different jurisdictions might have unique tax obligation treaties that can additionally minimize the total tax problem on income created from investments held within the depend on. By leveraging the competence of an overseas trustee, customers can navigate complex tax obligation regulations much more effectively, making certain compliance while taking full advantage of tax obligation benefits.

Furthermore, offshore trust funds can provide opportunities for you can try here resources gains tax deferral, supplying a means to expand riches without immediate tax ramifications. The ability to framework investments and revenue streams via an overseas entity enables tailored monetary preparation, aligning with specific tax methods and lasting financial objectives. Ultimately, an overseas trustee can be a critical element in maximizing tax effectiveness in an extensive monetary strategy.

Succession Planning Benefits

Many individuals overlook the critical role that offshore trust funds can play in reliable succession planning. Offshore trust funds give a calculated system for transferring wide range throughout generations while ensuring that assets are secured from prospective financial institutions and lawful disagreements. By positioning assets in an offshore count on, people can assign beneficiaries and overview particular problems for asset circulation, thus keeping control over how link their riches is taken care of long after they are gone.

Furthermore, offshore trusts can alleviate estate tax obligations and reduce probate difficulties. Given that these depends on are commonly developed in jurisdictions with favorable tax obligation regulations, they can lessen tax obligations, permitting more wide range to be protected for recipients. Furthermore, the privacy managed by overseas depends on can shield the information of one's estate from public scrutiny, securing household passions.

Navigating International Laws

Reliable sequence planning via overseas trusts necessitates a detailed understanding of worldwide policies. As monetary landscapes come to be significantly globalized, people seeking to shield their properties need to navigate a complex web of regulations regulating overseas structures. Each jurisdiction has its own collection of laws relating to asset tax, defense, and reporting needs, which can vary substantially.

When involving an offshore trustee, it is vital to ensure that they are fluent in both the legislations of the jurisdiction where the trust is developed and the guidelines of the recipient's home nation. This dual understanding assists mitigate risks connected with compliance failings, which might cause serious penalties or unintended tax obligation obligations.

Additionally, international guidelines, such as the Usual Coverage Criterion (CRS) and International Account Tax Compliance Act (FATCA), impose strict reporting commitments on financial organizations and trustees. Failure to abide can threaten the privacy and safety advantages of the trust fund framework. As a result, picking a trusted offshore trustee who has the requisite expertise in international guidelines is crucial for reliable economic preparation and property protection. This diligence not just safeguards assets however also guarantees adherence to the advancing global regulative environment.

Conclusion

In final thought, the involvement of an offshore trustee offers numerous advantages for effective monetary preparation. By executing robust property protection strategies, improving personal privacy, and enhancing tax obligation opportunities, offshore trustees play an important role in protecting wealth. Their experience in succession planning and navigating worldwide regulations guarantees a smooth shift of properties across generations. The use of offshore trustees ultimately adds to the long-lasting security and development of monetary profiles in an increasingly complicated international landscape.

In today's complicated monetary landscape, the function of an overseas trustee can be pivotal for individuals seeking to improve their financial preparation approaches. By utilizing an overseas trustee, clients can distance their possessions from public documents, making sure that their financial events stay confidential.

The capability to structure financial investments and revenue streams through an offshore entity permits for tailored economic preparation, aligning with individual tax obligation strategies and find more lasting economic goals. As economic landscapes become progressively globalized, individuals looking for to protect their assets should browse an intricate web of regulations regulating offshore frameworks. Picking a reputable overseas trustee that possesses the requisite proficiency in international guidelines is essential for reliable financial planning and possession defense.

Report this page